The Tax Benefits of IRAs

It’s tax season—the perfect time to ensure you’re taking advantage of the wide variety of tax-savings vehicles that the U.S. retirement system offers.

Did you know there are two different types of individual retirement accounts (IRAs) available that both offer specific tax benefits? Unlike a 401(k) or other employer-sponsored retirement plans, anyone with earned income (or a spouse with earned income) can open an IRA and take advantage of the tax savings.

IRAs have been around for nearly 50 years, and their popularity as tax-deferred retirement accounts continues to grow. In fact, 44% of U.S. households reported that they owned IRAs as of mid-2024, up from 34% a decade ago.

There’s a good reason IRAs are gaining popularity: Like 401(k)s and other employer-sponsored retirement plans, IRAs offer key tax advantages for Americans to maximize their retirement savings. They’re also more accessible to a greater share of Americans, especially those who work part-time, for multiple employers, or are freelancers.

Traditional and Roth IRAs

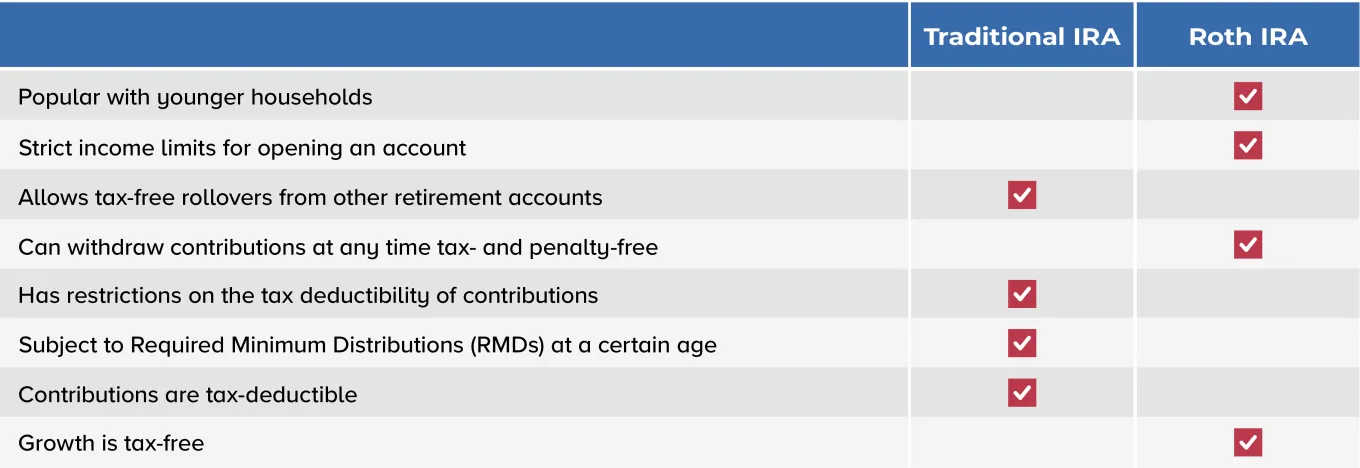

In the U.S., there are two kinds of IRAs: traditional and Roth. Below are some of the major similarities and differences between a traditional IRA and a Roth IRA:

IRAs Help Americans Plan for Retirement

ICI research shows that many Americans use IRAs as a complementary savings vehicle to employer-sponsored retirement plans, with nearly 9-in-10 IRA-owning households reporting that they also had employer-sponsored retirement plan accumulations or defined benefit plan coverage.

But IRAs aren’t just supplemental retirement accounts. They also make sense for Americans who want a retirement account with diversified investment offerings and products. For example, an IRA may be a good option if:

- Your employer doesn’t offer a retirement plan, and you are looking for a tax-advantaged platform to save for retirement.

- Your employer’s retirement plan has limited options, and you want a retirement account with more investment options or bespoke investment offerings.

- You have worked for multiple employers over the course of your career and are looking to consolidate assets from many employer-sponsored retirement accounts into one. (Traditional IRAs were first created to facilitate rollovers, and rollovers from other retirement accounts are tax- and penalty-free with a traditional IRA.)

Tax Considerations for IRAs

IRAs are powerful tax-advantaged savings vehicles. If you earn income from your investments within an IRA, from dividends or realized capital gains for example, you wouldn't pay taxes on them as long as they remain in the account. With an IRA, you can invest contributions and sit back as this money grows and compounds over time.

However, major provisions of U.S. tax policy are set to expire at the end of 2025, which could impact retirement accounts like IRAs. As Congress considers how and where to trim the budget in an effort to extend the 2017 tax cuts, the tax savings in IRAs and other retirement accounts could be on the chopping block.

Take Action

IRAs and other retirement accounts are helping millions of Americans save for a financially secure retirement. But Congress needs to know how much Americans depend upon and value these accounts.

Tell Congress to preserve the U.S. retirement system and not end important tax benefits for retirement accounts like IRAs, 401(k), and 403(b)s.