Individual retirement accounts (IRAs), 401(k)s, and similar accounts are key pillars of the U.S. retirement system. These retirement accounts have strengthened the middle class and given Americans of every income level and background a pathway to long-term financial security.

Not only that, a recent survey found that Americans are overwhelmingly happy with their retirement accounts! 72% of Americans have favorable impressions of 401(k) and similar retirement plans.

With support from Congress, access to 401(k)s and IRAs has expanded over time, delivering tangible benefits to everyday Americans. Combined with shoring up Social Security, the best way to help even more households reach a comfortable retirement is to build upon the many successes of these plans:

Automatic enrollment, automatic increases in contribution rates, and automatic investing—e.g., through target date funds—put workers on a strong retirement savings path, helping young and low-income workers the most.

87% of individuals with employer-sponsored defined contribution plans agree that the payroll deduction feature of their plans makes it easier for them to save.

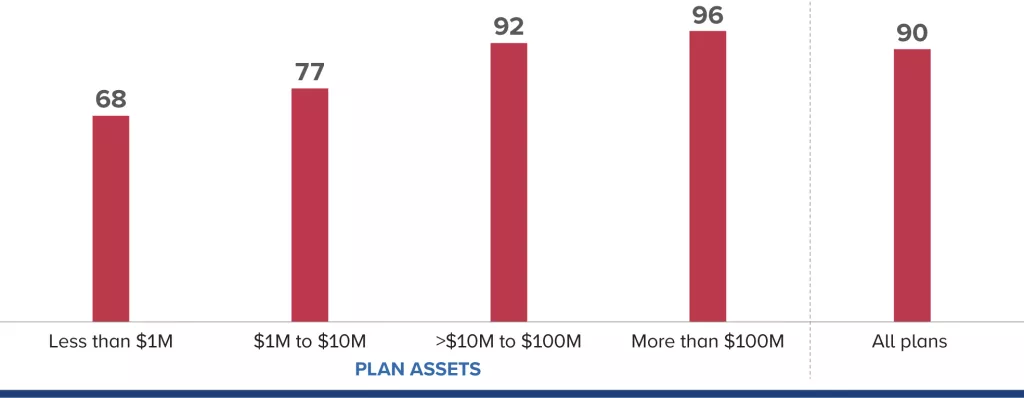

90% of 401(k) participants are in plans with employer contributions.

Recent mutual fund owners show increasing diversity and often are saving for retirement using funds held in 401(k)s and IRAs. And among Black households that own mutual funds, nearly 80% were first introduced to funds through their 401(k) or workplace IRA.

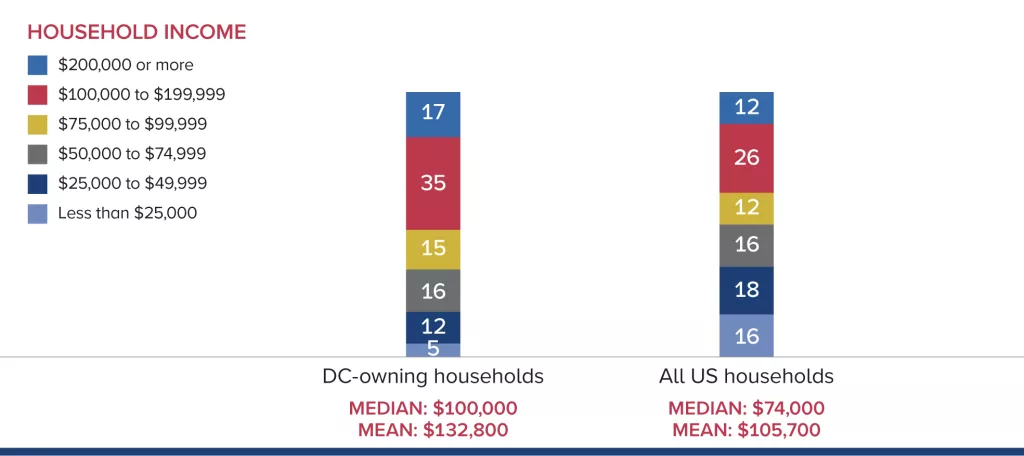

83% of households with 401(k)s or similar plans earn less than $200,000 per year, and roughly half earn less than $100,000 per year.

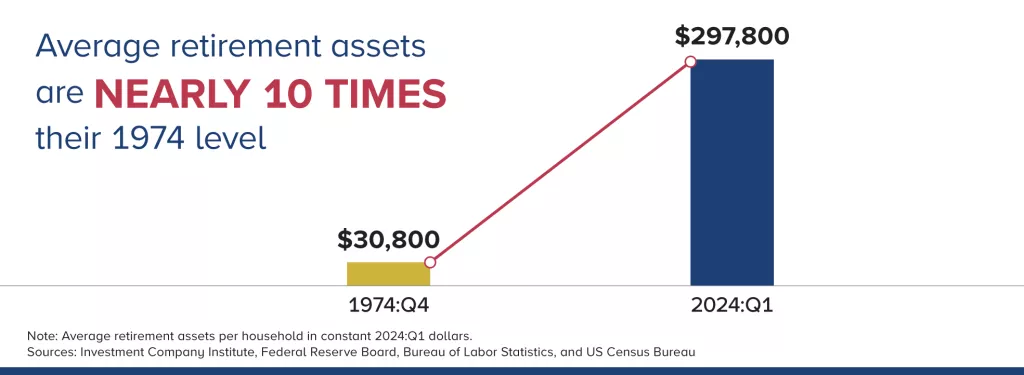

Powered by the growth of IRAs and 401(k)s, average retirement assets per household are nearly 10 times what they were 50 years ago, even after inflation.

Adjusted for inflation, taxes, and retirement contributions, the average 72-year-old replaces more than 90% of the spendable income they had in their mid- to late-50s, thanks in part to income from IRAs, 401(k)s, and similar plans.

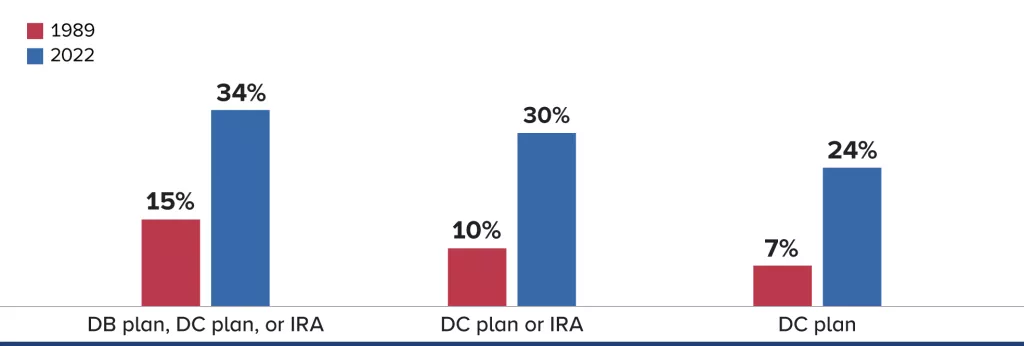

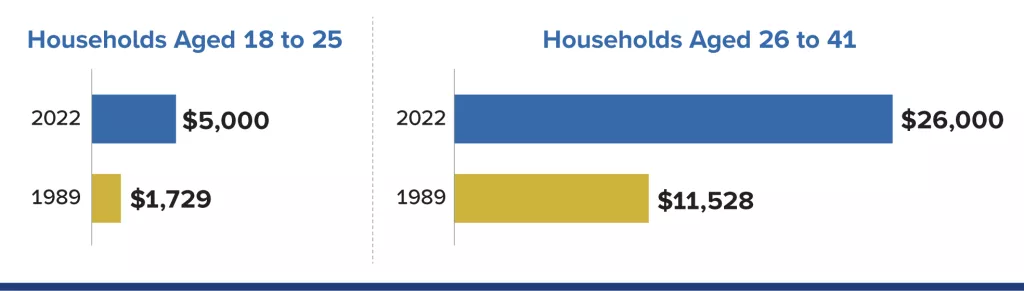

The percentage of Gen Z households with a retirement account is twice that of similar-age Gen X households in 1989.

Adjusted for inflation, Gen Z and Millennial households have more than double the savings in 401(k)s or similar plans than their same-age counterparts had decades ago.

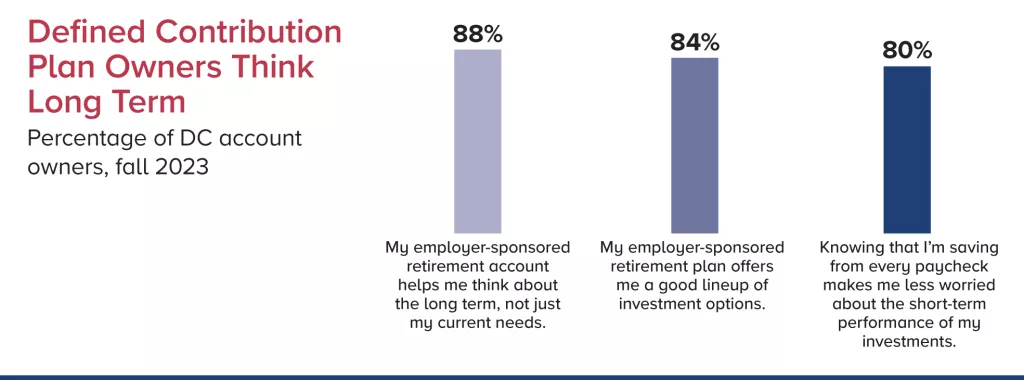

Roughly 90% of individuals with a 401(k) or similar plan say their plan helps them think about the long term, not just their current needs.

About two-thirds of traditional IRA−owning households say they have developed a strategy for managing income and assets in retirement, often in consultation with a financial professional.

Americans value the choices available in their defined contribution retirement plans, as well as the control they have over their investments. In fact, more than eight out of 10 Americans with defined contribution plans think their retirement plan offers a good lineup of investment options.

81% of Americans with defined contribution accounts or IRAS are confident that their accounts can help them meet their retirement goals.

The Bottom Line

IRAs, 401(k)s, and similar accounts are working for Americans, making retirement security a reality for the majority of households. By preserving the features of these retirement accounts that Americans rely upon and building upon their successes through the One Big Beautiful Bill Act, policymakers once again supported an established framework that strengthens the middle class today and for generations to come.